Extensive payment experiences

We were the first Stripe-Certified Agency Partner in the world. A key part of any online business is generating, then collecting, revenue. Stripe is a world-leading payment processor, who makes it much easier for your customers to pay you, and for you to get the money quickly!

Square1 has been working closely with Stripe for many years. In 2018 we became the first agency in the world to be recognised as a Stripe Partner Agency, and maintain a large number of people in our team with Stripe-issued Certifications as Developers and Architects. Our team of experts stay up to date on the latest products from Stripe, meaning that we can design the optimal solution to get your business to market - whether it’s a bespoke integration, a low-code or no-code implementation, or a hybrid of each approach.

Choosing the right payment stack

Stripe offers a wide variety of products, to suit all different types of businesses. Having worked with Stripe implementations of all shapes and sizes, our team is ready and able to design the most appropriate payment flow for your business.

Payment Links: A “no code” solution, these are links which can be created directly from the Stripe dashboard, and sent to users to pay via a co-branded, Stripe-hosted page.

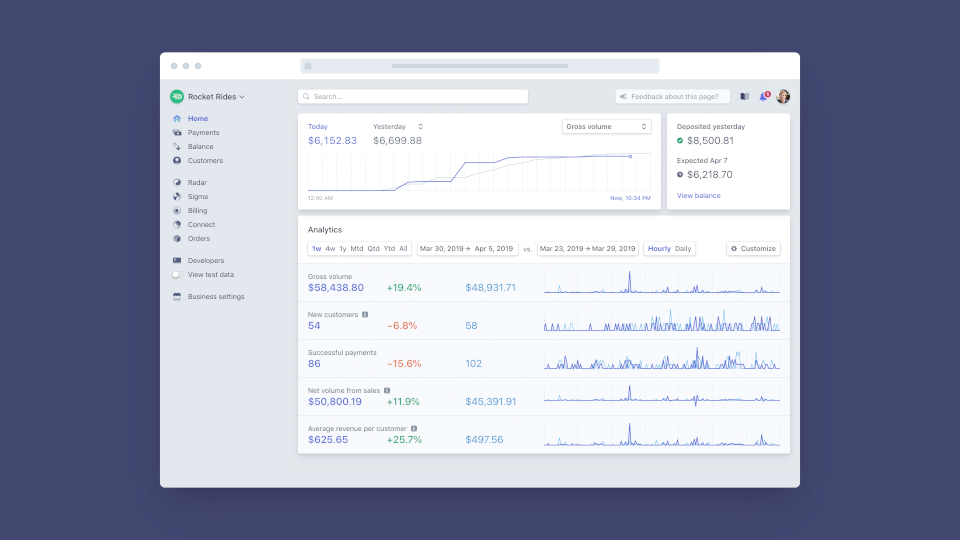

Billing: Stripe’s product to support recurring billing and subscriptions. Manage your customer and subscription records directly in Stripe, taking advantage of Stripe’s comprehensive reporting (customer attrition, lifetime value, and other key insights). Intelligent payment recovery options can lead to a significant uplift in failed payment recoveries, helping keep your customers engaged for longer.

Invoicing: Automatic invoice reconciliation, and a collection and monitoring system for unpaid invoices.

Connect: Stripe Connect simplifies the process of setting up a marketplace, or payment platform. Fund flows are massively simplified, freeing up a lot of time for your operations team. Stripe provides simple tooling and alerting for KYC and AML checks in each country you’re operating in.

Tax: Automates the calculation and collection of taxes in more than 30 countries on your Stripe transactions, without third-party integrations. You will be able to directly generate reports for your tax return.

Radar: Take advantage of the strength of Stripe’s global network to recognise and block suspicious transactions before they happen. Reducing fraud, and avoiding chargebacks, this anti-fraud engine can be customised with bespoke rules to fit your business needs and customer profile.

Why Stripe?

Stripe provide a number of key advantages over other payment gateways:

Global coverage: Accept payments from customers anywhere in the world

Customizable checkout: Ability to fully customise the checkout experience to match your brand.

Security: Stripe uses industry-standard security measures to protect both the business and its customers.

Mobile optimization: Stripe's mobile-optimised checkout offers a smooth payment experience on any device.

Recurring payments: Easily manage subscriptions, recurring invoices, and instalment plans.

Multi-currency support: Ability to accept payments in multiple currencies and automatically convert them.

Platform support: Native tools to simplify fund flows on your platform.

Seamless integration: Integrates with various e-commerce platforms and custom websites.

Advanced analytics and reporting: Access detailed payment and transaction reports, as well as real-time analytics.